Conserves Time - When contrasting health insurance plans online, you will certainly not be needed to invest a lot time loading types or talking about with agents or execs. All you require to do is fill a quote and also numerous medical insurance plans will be shown on your display which you can compare conveniently. If you want to make sure a smooth clinical health insurance buying procedure, after that you need to pick a reputed insurance provider that uses you enough details regarding the health insurance strategy purchased.

However, one needs to obtain hospitalized for a minimum of 1 day. This plan covers for your covid-19 a hospital stay cost, bills associated with AYUSH therapy that increase to Rs. 5 Lakh & expenses connected to home treatment. These consumable things consist of PPE sets, oxygen cylinders, ventilators, masks, gloves and so on. You might not have the ability to function while you're laid up, which implies that you might lose on pay too. Despite having insurance coverage, you might locate itdifficult to spend for healthcare costsin these instances.

- To be able to do so, you will certainly need to inform your existing health insurance provider as well as technique the new business that you want to obtain your health insurance plan ported to.

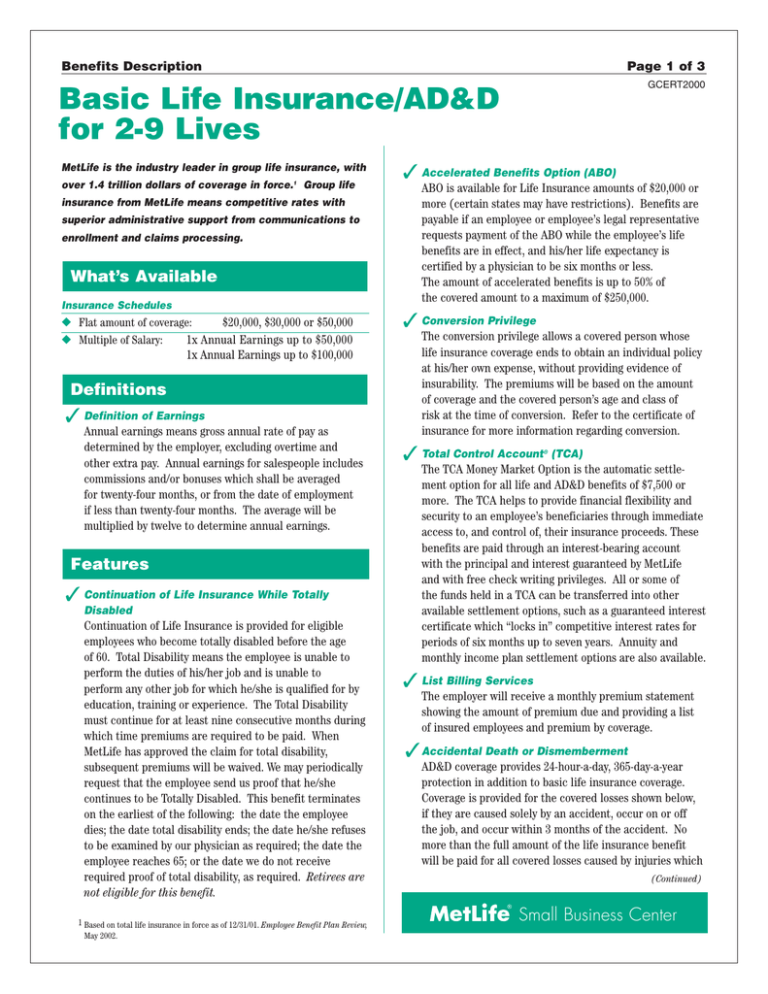

- Typical benefits supplied under these strategies include unexpected fatality cover, permanent/total disability cover, momentary complete special needs, healthcare facility cash advantage, transport of temporal remains, and so on.

- Apart from this, purchasing a health insurance plan likewise lowers your total tax responsibility by permitting you tax deductions on the costs paid, under Section 80D of the Income Tax Obligation Act, 1961.

- Sum Insured - Amount insured ought to be picked intelligently as it covers you and your liked ones for medical costs sustained throughout the whole plan term.

- In 2021, the government poverty line is $12,880 for an individual, so individuals making much less than $51,520 may be qualified to subsidised medical insurance.

Once you select the plan which meets your needs with the least quantity of premium, you can go on and also pay the medical insurance premium or talk to our customer support to get the insurance policy. While it is understandable to choose the plan with the least insurance coverage premium, it is vital to recognize that various elements can impact your medical insurance premium. If you have a cashless policy, you need not fret about having a big amount of cash money throughout an emergency. Many health insurance policies likewise supply ambulance cover and also emergency a hospital stay expenditures.

It is extremely tough to pay for clinical costs without health insurance, particularly if you are checked out a health center even just overnight. In medical insurance, the insurance policy service provider may use a No Insurance claim Incentive to the policyholder if specific terms and conditions are satisfied. The insurance holder should not have made an insurance claim throughout the previous policy duration in order to get the No Claim Bonus. Initially, where you get hospitalised prior to the plan expiration date as well as notify the insurer prior to the policy lapses, and the plan gaps when you are still in the health center.

Q: What Occurs If My Medical Plan Gaps Throughout Hospitalization?

You can contact us in instance of any complication pertaining to medical insurance policy purchase, claim negotiation procedure, health insurance renewal, etc. So, when selecting a medical insurance business, see to it you select the one that has a high variety of network health centers nearby your place of residence. Complying with are the essential functions of medical health insurance strategies.

Purchasing a health insurance policy throughout very early age can be cost-effective as one might not always need to undergo clinical examinations conducted by the insurance firms. Lifestyle Habits - Way Of Living practices such as excessive smoking cigarettes or drinking degrade your health and wellness and make you more prone to diseases. If you follow Browse around this site this way of life, then you may go to higher health and wellness danger How To Save Money On Health Insurance and therefore will certainly be more likely to make an insurance claim.

Here's How Much The Ordinary American Spends On Healthcare

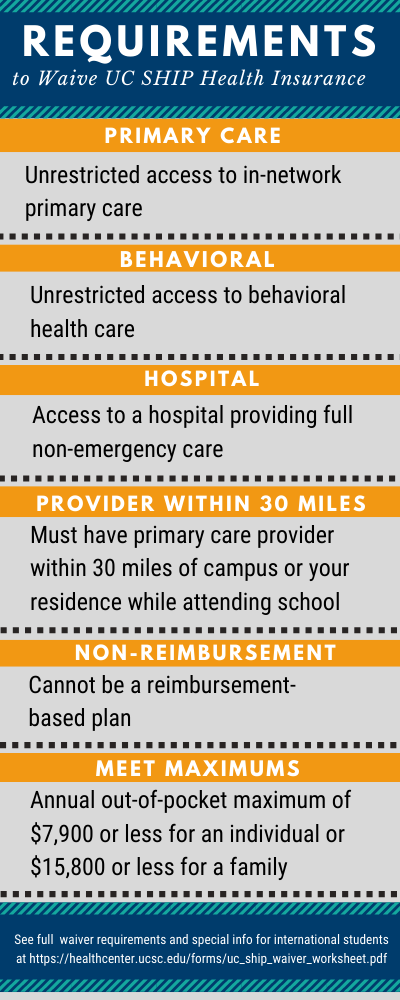

Therefore, it is important to consider just how much medical insurance you require, particularly if you have enjoyed ones to sustain. A health insurance policy can aid cover necessary clinical costs-- such as intended hospitalisation, clinical emergencies, and non-hospitalisation treatment. Along with the metal strategy classifications, some individuals are qualified to acquire a strategy with catastrophic coverage. Catastrophic plans have extremely reduced costs and really high yearly deductibles ($ 8,150 in 2020). Nonetheless, they spend for preventive treatment regardless of the deductible. These strategies might be an appropriate insurance coverage alternative for young, healthy people.

Corona Rakshak plan is an advantage based item that provides a lump sum settlement for a hospital stay expenditures upon the medical diagnosis of coronavirus throughout the policy term. The minimum plan term is 3.5 months and also the maximum is 9.5 months. Space Rent Waiver- The room lease waiver guarantees that your health insurance plan covers the lease for the health center area of your selection during hospitalization.

From What Age Can I Include My Kids In My Existing Health Insurance Plan?

Many companies select to make use of an HRA administration carrier like PeopleKeep to evaluate documents and keep conformity. As soon as a cost is verified, the company reimburses the worker via their recommended method (e.g., pay-roll, check, money). 4 The Firm shall forgo all future premiums on a case of Minor condition under the chosen cover; or on the diagnosis of Irreversible Impairment of the Life Assured as a result of a Crash. If both Cancer cells cover and Heart cover are selected such waiver is enabled on a minor/major condition insurance claim under either Cancer cover or Heart cover; or on the medical diagnosis of PD. This advantage is offered only if the Policy is in pressure as on the day of diagnosis of the condition/at the moment of mishap. 1 The costs rate is of 10 lakh Cancer cover as well as 10 Lakh Heart cover for 35 year healthy and balanced man for policy regard to two decades and inclusive of tax.

The former deals various other insurance products as well like cars and truck insurance coverage, bike insurance policy, whereas the latter offers medical insurance intends just. Co-Payment - Co-payment is when the insurer and also policyholder share the expense in situation a claim emerges. So, to deal with your savings, you must choose a health insurance plan that comes with no co-payment. The ordinary costs for household coverage has enhanced 22% over the last 5 years and 55% over the last 10 years, substantially more than either workers' incomes or inflation.